10 Questions to Ask a Disability Lawyer Before You Sign

Let’s face it: it’s daunting to hire an attorney. There are thousands of lawyer jokes for a good reason. But sometimes in life you need a good advocate in a legal proceeding, or just someone to give advice before the going gets rough. Hiring an attorney requires careful consideration of not just the finances of the relationship, but also a determination of whether she will be a good fit for one of the most significant professional relationships you will likely have. These questions will help you avoid making mistakes when choosing an attorney who suits your style.

Q1. Can you give me a cost estimate?

Attorneys will not be offended by this question. We know it’s pricey to hire a lawyer and you need to plan for it. A good attorney will offer a variety of options to work with your budget and risk tolerance. If an attorney offers to work on a “contingency fee,” that means she will work unpaid until securing money on your behalf, and then her fee will be a percentage of that award. Typical attorney contingency fees range from 33-40%. If an attorney offers an hourly rate, be sure to ask if other attorneys in the office can do some of the work at a lower rate, and if administrative tasks can be handled by paralegals or legal secretaries, as this might be a way to reduce the monthly bill. Also ask if the attorney bills in .1 hour or .25 hour increments and if she bills for small emails or voicemail exchanges. Some attorneys may offer a “flat fee,” or you could suggest that option yourself. Many clients like the certainty of a financial cap: but beware the unethical attorney who would accept that amount of money then work as little as possible. You need to trust the attorney you hire before agreeing to any of these arrangements, but especially the flat fee. If you get a “shark vibe,” look in another direction. Also, if you have a creative idea, feel free to propose it! At the very least, it will give you an idea of how open-minded your future attorney might be.

Q2. Can you tell me how you would approach my case?

Most attorneys tread very carefully about giving legal advice without a retainer agreement in place, as they do not want to create an attorney-client relationship where there really is not one. A good attorney will listen to your problems, describe how she might handle your case, and may give some general information or direct you to a resource, but steer clear of an attorney who is over-eager to breach ethical constraints by doling out free advice just to nab you as a client.

Q3. How do you handle these types of cases?

An experienced attorney should have an easy answer to this question. For example, as an ERISA attorney, I am clear about what needs to happen to maximize the chance of a successful outcome when, for example, appealing a denied disability benefit claim. If it was my first rodeo, I wouldn’t have a firm plan of action. Look for a thorough and confident answer to this question.

Q4. Have you ever handled a case with facts similar to mine?

In my area of the law, I interact with people who have myriad ailments causing their disabilities. My clients feel comfortable off the bat if they know I am at least familiar with their medical conditions, and you probably will too.

Q5. How accessible are you?

Some attorneys specialize in reeling in clients and then disappearing. Make sure your attorney will be involved in your case from start to finish, even if she doles out assignments to others in her law firm. Just like most professions, attorney skills and personalities vary widely, so make sure that you are getting what you’ve paid for. Which leads me to…Question 6:

Q6. What are your past results in cases at the same stage as mine?

No attorney could possibly guarantee an outcome in your case – there are too many variables. But an attorney should definitely be able to describe similar cases she has handled and what the outcome has been.

Q7. Will attorneys or paralegals do most of the work in my case?

A law firm that has a paralegal doing attorney work (writing substantive letters, making strategy decisions on cases, etc.), is very different from a law firm where the attorneys do all of the attorney work. Be sure you know who will be working on your case and their credentials.

Q8. What are you most proud of in your career? In your personal life?

Get a sense for the attorney’s values by asking her to describe a case that has meant something to her. You’ll understand a lot about her style and substance by hearing her describe a proud moment. If she’s willing to discuss a proud personal moment, that could be a great opportunity for you to see who she really is. I figure that clients have to entrust a lot of sensitive information to me about their lives, so I definitely don’t mind sharing now and again about my own if asked. It’s the least I can do to bond with my client on a human level.

Q9. At what stage do you get a positive outcome for most of your clients?

Some attorneys like to get to court as quickly as possible. Some attorneys like to try to secure a victory at an earlier stage for their clients. If you are a “rush to court” person, you should find an attorney with a similar mindset. If you prefer an attorney who tries to get a positive outcome sooner, even without having to file a lawsuit, you should hire an attorney who shares a similar point of view.

Q10. How involved do I have to be?

My style is to include the client if she wants, but my preference is to just let her sit back, relax, and let me handle the nitty gritty details of her case without stressing her. Some attorneys may want more client involvement, particularly if they can get a client to do some of the legwork. Figure out how much involvement is comfortable for you, and make sure your potential attorney is a good match for your comfort-level.

Above all, make sure that you like your potential attorney. You will talk with her for hours, email frequently, and she will know more about you than many others in your life might. If you like her, feel like she understands you as a human being, and that she will work tirelessly for you, then it’s a match. And, of course, if you want to talk to me about a disability benefit application, appeal, or lawsuit, feel free to call and ask me any of these questions!

Read MoreLong Term Disability (LTD): The Hidden Gem in Your Benefits Package

What is an LTD benefit?

Most long-term disability benefits are insurance policies that provide about 50-67% of your base income should you become disabled. What does it mean to be disabled? It will be defined in the policy, but typically it is defined as the inability to perform the material duties of your occupation due to illness or injury. After some time, usually 24 months, the definition of “disability” may change to the inability to perform the material duties of any occupation (taking into account your education, training, and prior income level) due to illness or injury. Mental illness disabilities are usually limited to 24 months of benefits in total.

Many illnesses or injuries can qualify you for a disability benefit. Examples include back, neck, knee, or upper extremity pain, migraines, fibromyalgia, cancer and its consequences, HIV/AIDS, pulmonary dysfunction, cognitive impairment, neurological conditions like Parkinson’s Disease, or chronic pain conditions. Disabilities do not just strike the elderly; my clients range from ages 29-67, with most of them being in their 50s. Yet they all have one thing in common: none were expecting to have to stop working before retirement age due to a medical problem.

Who has an LTD benefit plan?

Most professionals work for employers that provide disability benefit plans. These disability insurance policies have relatively low premiums, so employers often provide disability insurance to their employees as a matter of course. If you work for an employer that provides professional, medical, or technology services you are a prime example of someone who probably has a disability benefit plan through your employer. For example, I frequently represent doctors, nurses, and other medical professionals, lawyers, engineers, project managers, programmers, financial services professionals, executive directors, and even insurance claims adjusters. To see if you have disability coverage, look up your original benefits package or examine what benefits you elected. You can also look up your employer’s IRS Form 5500 filing, which should include details on ERISA retirement and “welfare” benefits such as health, disability, and life insurance benefit plans. ERISA is the law that governs almost all employer-sponsored benefits.

What to do if you need to apply for LTD benefits?

If your doctor has advised you to stop working, please verify whether your employer has an LTD plan or give me a call and I’ll help you figure it out. There are other benefits that might be available to you as well (state disability, Social Security, workers’ compensation, etc.), which I can outline for you. If your employer does have an LTD plan, bear in mind that the reason you stop working has to be because of your disability for you to have coverage and make a successful LTD claim. In some states, including California, late applications can still be accepted as long as the insurer is not harmed by your late claim notice. Typically, your last date of work is also your first date of disability. If you are laid off for performance reasons that are actually related to your disability, you may still have a good LTD claim, but call me to help you analyze it. (You may also have a disability discrimination claim.) If you 1) have an employer-sponsored LTD plan, 2) need to stop working because of a medical condition, and 3) your doctor has advised you to stop working and will fill out a form on your behalf, you should strongly consider applying for LTD benefits. These benefits may be available until age 65 or 67, so do not shy away from making an application! However, there are many traps along the road of applying for and receiving LTD insurance benefits, so feel free to reach out to me if you have any questions about whether you should apply or how to maximize your chances of receiving benefits.

#LTD benefits

My Patient Needs to Stop Work … Now What?

By Cassie Springer Ayeni, Disability and Life Insurance Benefits Lawyer

with Springer Ayeni, A Professional Law Corporation

cassie@benefitslaw.com . www.benefitslaw.com

It happens: your patient comes to an appointment, and after months or years of “getting by” at work, despite a degenerative or chronic condition, it is clear to you that those days are over. You recommend that for her health, she stop working. Now what?

What your patient now faces is a host of forms and requests from insurance companies and the government to ensure that she has some income even though she’s not working anymore. Besides savings (and it is unheard of for someone in the prime of her working life to have sufficient savings to live decently for the rest of her days), income sources for people with disabilities include:

- Employee benefit plans (short-term disability then long-term disability). Long-term disability usually starts after 6 months and can last until retirement age.

- Private disability insurance plans (also lasting until retirement age).

- State disability insurance that usually last for a year (like California’s EDD).

- Social Security Disability Benefits (available after being disabled for a year and lasting through retirement age).

To qualify for any of these benefits, the #1 thing that a patient needs is help and support from the doctor. Without it, she won’t be approved; and if support wanes in the future, the insurance companies won’t hesitate to cut off her benefits. Here’s what you can do to help ensure that your patient receives disability benefit income on time and without hiccups:

Medical Records

- Document the reason why the patient is disabled in the medical records. List as many objective findings as are available (ROM, atrophy, MRIs, visual findings, etc.), including your objective observations.

- Document in the medical records whether the patient’s complaints of pain, fatigue, or other disabling symptoms are credible.

- If the patient has worked with the condition, answer the question in the medical records of “why now?” Why was she able to work before with the condition but suddenly cannot? Has there been a worsening of symptoms? Do you feel that her best chance of getting better is by resting for a bit at home? Document your rationale in the medical records.

- When the patient gets approved for benefits, keep track of the symptoms in regularly scheduled check-ups; insurance companies request updated medical records every 6-12 months.

Forms Requests

- Be sure to complete and return forms as quickly as possible. Although it is tempting to punt the form-filling to a secretary, it is more credible when completed by you.

- If there are any boxes on the forms that not applicable to your patient, just write N/A or rephrase the question so it makes sense for your patient

- Beware of traps in the questions: If a question states “how often can your patient work? 3 hours, 6, hours, or 8 hours a day,” but you feel your patient could only work 1 hour a day with breaks and unreliable, don’t check a box; just write your true response.

Working with the Lawyers

- Thankfully, with the increasing popularity of medical-legal alliances, most physicians and lawyers now truly comprehend their shared interest in the patient’s well-being, and working together on the insurance requests helps for seamless communications with the insurer. A patient about to go on disability can benefit from a quick call to a benefits attorney to make sure that every “I” is dotted and “t” is crossed.

- A patient whose disability benefits claim has been denied should never attempt to appeal on her own without the benefit of some legal advice.

- Also, even when a patient is approved for benefits, don’t hesitate to ask her lawyer for help understanding the forms; the lawyer and the patient will appreciate it more than you know.

Cassie Springer Ayeni is the President and Founder of Springer Ayeni, A Professional Law Corporation, in Oakland, CA, where she focuses on ERISA disability and life insurance cases. She can be reached atcassie@benefitslaw.com or www.benefitslaw.com

Read More

ERISA Disability Traps & Tricks for the Non-ERISA Practitioner

By Cassie Springer Ayeni, President Springer Ayeni, A Professional Law Corporation

The Employee Retirement Income Security Act, better known as ERISA, is referred to by at least one judge as “Everything Ridiculous Imagined Since Adam.” Florence Nightingale Nursing Service, Inc. v. Blue Cross and Blue Shield, .832 F. Supp. 1456, 1457 (N.D. Ala. 1993), affirmed, 41 F.2d 1476 (11th Cir. 1995) (Acker, J.). It gets its sordid reputation from its limited remedies, roots in trust law, and limited discovery rules. Yet ERISA is so vast that every lawyer should know a little bit about it.

Most practitioners know that ERISA covers employer-sponsored retirement plans, yet few realize that with minor exceptions[1] it also governs all employer-sponsored health plans, disability benefit plans, and life insurance plans. 29 U.S.C. § 1002. Of these categories of ERISA litigation, disability benefit lawsuits comprise 64.5% of ERISA litigation, health care accounts for 14.4% or ERISA litigation, and pension just 9.3%. Anderson, S., ERISA Benefits Litigation: An Empirical Picture, 28 ABA J. Lab. & Emp. L. 1 (2012) at p. 7. Why is that? Though ERISA was originally designed to protect pension claims, more and more employers are eliminating traditional pension plans for employees or have outsourced to fiduciaries, and ERISA provides limited relief for breaches of fiduciary duties. Health claims are notoriously mishandled (we all probably have our own examples of that!), yet if a plaintiff brings an ERISA claim for denied health benefits, the remedy is that the medical provider gets reimbursed, and there are no punitive, compensatory, or consequential damages available to the plaintiff. Disability benefit claims, however, are another story. If a worker with an employer-sponsored disability benefit plan files a claim for benefits, that claim is typically administered and paid for by an insurance company. And because these insurers have a financial conflict of interest, many disability benefit claims are denied despite the claimant’s doctor’s decision that the claimant should stop working. The remedy under ERISA is payment of the disability benefits through the date of judgment, and benefits can potentially continue until retirement age. In other words, disability benefits are worth a lot over the claimant’s working lifetime. That’s why a little ERISA knowledge comes in handy for any practitioner.

Screening for ERISA

First, in screening these calls from potential clients, be aware that some issue spotting will be incredibly valuable, as most individuals do not even realize that their claim for disability benefits is governed by ERISA. Most individuals call with an assumption that the appropriate area of expertise is disability discrimination, workers’ compensation, Social Security disability, or California state disability insurance. But if the employer offered a disability plan, it is ERISA help they need.

TRAP #1: Assuming that the potential client knows what kind of attorney she needs for her disability issues. TRICK #1: Simply ask “did your employer offer a disability benefit plan?” If so, ERISA will probably govern.

Severance Waivers of ERISA Claims

Second, many people with disabilities may contemplate quitting their job for performance issues or have already been told they will be terminated. If they are getting close to retirement age, they may assume that an early retirement is the honorable way to exit the job. The disabled worker may be offered separation or severance pay, but many standard separation or severance agreements actually waive all claims under ERISA! If someone could potentially obtain a monthly disability benefit until retirement age through their disability benefit plan, this is an extremely valuable benefit to waive in exchange for severance. Indeed, the prudent plaintiff’s attorney should routinely screen for disability if negotiating severance, as no one would want to give the green light for waiving hundreds of thousands of dollars in disability benefits in exchange for a little severance.

TRAP #2: Failing to edit out a waiver of ERISA claims. TRICK #2: Carve out any claims for disability benefits, health benefits, or pension benefits that might arise under ERISA. An example of a good carve out is: “However, the following claims are specifically and expressly excluded from the foregoing Release: (i) health insurance benefits under ERISA or the Consolidated Omnibus Budget Reconciliation Act (COBRA); (ii) claims with respect to benefits, including short- and long-term disability benefit benefits, under a welfare benefit plan governed by the Employee Retirement Income Security Act (ERISA); or (iii) claims with respect to vested benefits under a retirement plan governed by ERISA.” Most employers understand the practicality of this, particularly because such claims are usually (but not always) filed against the disability insurer, not the employer.

Strict ERISA Deadlines

Third, although it is best for the potential client to find an ERISA attorney before making the decision to apply for disability benefits, most do not. Rather, most potential clients try to find legal help only after the insurer has denied the claim for disability benefits. At that point, ERISA’s Regulations prescribe a 180-day period for appealing the denied benefit claim. This process MUST be completed or else the claimant loses the right to file suit, also known as “failure to exhaust administrative remedies.”

TRAP #3: Failing to submit an appeal of an adverse disability benefit decision within 180 days of receipt of that decision. TRICK #3: Don’t miss this deadline! But if all else fails, immediately call the insurer to request an extension. ERISA’s regulations allow for “at least” 180 days, but it is up to the insurer to allow an extension. If granted over the phone, immediately follow it up in writing and indicate a date by which the claimant will submit the appeal.

Evidence in the Appeal

Fourth, although filing a hasty appeal is all that is necessary to preserve the ability to file a lawsuit, a scant appeal letter will not win the appeal, nor will it enable an ERISA practitioner to take the case for litigation. ERISA disability litigation is limited to the factual evidence presented in the aforementioned administrative appeal. Once in court, in all but rare circumstances, there will be no depositions, further medical records, or opportunities for direct or cross-examination. And there are also no jury trials. So if you help someone with their disability benefit appeal, please be sure to include all evidence necessary to win the case down the road.

TRAP #4: Assuming that there will be a chance in court to put in more evidence supporting the disability claim. TRICK #4: Throw in everything but the kitchen sink into the appeal! If you think the evidence might be useful in litigation, put it into the appeal. Declarations from the client, friends, family, medical providers, and colleagues, as well as all relevant medical records and expert reports, are key to submit in the appeal of a denied claim.

Filing an ERISA or ERISA-Related Claim

Finally, if you do decide to litigate an ERISA claim, be aware that these claims must be brought in federal court or you will face removal of the ERISA claims and all claims related to the ERISA claims. With limited exceptions, if you are bringing state law claims and ERISA claims, ERISA will preempt those state law claims.[2]

TRAP # 5: Failing to separate any state law claims from ERISA claims. TRICK # 5: Don’t even mention ERISA or other employee benefits or benefit-related remedies in your state law complaint. Leave the ERISA claims alone and litigate those separately as ERISA claims in federal court, or face removal.

TRICK #6: Give me a call. I’m an ERISA nerd and I’m happy to field your ERISA questions! 510-926-6768 Option1, or cassie@benefitslaw.com

Cassie Springer Ayeni is the President of Springer Ayeni, A Professional Law Corporation, in Oakland, CA, where she focuses on ERISA disability and life insurance cases. She can be reached at cassie@benefitslaw.com or www.benefitslaw.com

[1] Those exceptions are for public employees (anyone who works for the government such as teachers, legislators, public safety officers, etc.), and “church plans,” (anyone employed, even tangentially, by a religious organization including those who work at Catholic hospitals).

[2] ERISA’s “savings clause” provision saves from preemption any law that regulates insurance, banking, or securities. ERISA § 514(b)(2)(A). An example of the application of the savings clause is in California’s “notice prejudice” rule, which provides that claims can proceed even where there is late notice unless the insurer is prejudiced by the late notice. Because this is a law that regulates insurance and does not provide a remedy that conflicts with ERISA, the law is not preempted. UNUM Life Ins. Co. of Am. v. Ward, 526 U.S. 358, 373, 119 S. Ct. 1380, 1389, 143 L. Ed. 2d 462 (1999).

Read More

How to Apply for Long-Term Disability When You Stop Work

By Cassie Springer Ayeni

You never thought it would happen.

You thought you would work until retirement or beyond, but then along came your vestibular disorder. Now, focusing on a computer screen is a challenge; someone has to drive you to work; walking is a safety hazard; and your concentration is not what it used to be. All of these symptoms can interfere with your ability to do the material duties of your occupation, and can make an attempt to get through a workday exhausting and frustrating as you struggle to complete tasks that used to be easy for you. You

see your doctor and she tells you the time has come to stop working due to your disability. Now what? How will you live without your income? Here are some options and a plan:THERE ARE SEVERAL SOURCES FOR DISABILITY BENEFITS Besides savings (and it is almost unheard of for someone in the prime of her

working life to have sufficient savings to live decently for the rest of her days), income sources for people with disabilities include:

1.Short-term disability insurance benefits through your employer (these usually last for 6 months).

2.Long-term disability insurance benefits through your employer (these usually start after 6 months and can last until retirement age).

3.Private disability insurance plans (insurance you purchased for yourself that can last through retirement age or beyond).

4.State disability insurance (usually lasts for a year, such as through California’s Employee DevelopmentDepartment “EDD”).

5.Social Security Disability benefits (SSDI) (available after being disabled for 6 months and lasting through retirement age).

6.Workers’ Compensation benefits (if your disability is due to a work-related injury).

In this article we will focus on the first two of these income sources: short- and long-term disability benefit plans offered by your employer. (See VEDA’s other articles on how to apply for SSDI.)Many employers offer group disabilityplans to their employees because the premiums are low and they can be a huge benefit to employees struck with a disability, whether short- or long-term. These benefits are usually paid by insurance companies such as Unum MetLife, Hartford, Principal, Standard, Cigna/Lina, Guardian, Sun Life, and others.A complex area of law called ERISA (the Employee Retirement Income Security Act) governs these employee benefit plans, even though you apply to an insurance company for payment of the benefits. Under ERISA, there are technical rules governing timelines for the insurance company to decide whether to pay your claim. It is a good idea for you to get help with your disability application and, of course, with an appeal of any denials.

Important Tip: Even though you have a disability plan through your employer, you can still apply for all of the other disability benefits listed

above. However, the benefits are usually coordinated so that you only receive a fixed percentage of your salary altogether, usually 2/3 of yourprevious income up to a maximum benefit per month.

YOUR DOCTOR’S ROLE

Many people with vestibular disorders have a long-standing relationship with a supportive doctor. This relationship is instrumental to getting your disability benefit claims approved. Please make sure that your doctor knows how important it is that she fills out forms promptly so that your income stream can continue while you are not working. Here are some key tips for the “Attending Physician Statements” that you submit to the insurance company.

Tip #1:

Your doctor should answer the question “why is the patient disabled now?” especially if you have been struggling to work while symptomatic fora while. Did it worsen? Have your attempts to keep working caused a decrease in your performance? Is the fatigue from managing your symptoms getting the best of you, causing you to nap during the day? Are the symptoms interfering with your ability to perform the activities of daily living, such as preparing meals? Ask your doctor to be specific and make sure this is in your medical record.

Tip # 2:

One of the areas of misunderstanding with “invisible disabilities” like vestibular disorders is that a successful claim must depend on your report of “subjective” symptoms in addition to any objective tests. For the subjective symptoms to be deemed reliable by an insurance company, your

doctor should point out that you are credible in your symptom reporting. When your doctor notes this, it helps prevent the insurance company from doubting your credibility, an unfortunately common reality when insurance companies are looking for a way to cut costs. A good way to keep track of these symptoms is by keeping a log to share with your doctor: when you are nauseous or have a headache or a bout with vertigo, write it down in a log with a symbol for each symptom, then bring the log to every medical appointment.

Tip # 3:

If you have symptoms that can be objectively documented by testing, please get those tests done as soon as possible. For example, if you have concentration or other cognitive difficulties, ask for a referral for a neuropsychological examination, which provides objective evidence of those

symptoms.

Tip # 4:

Regularly schedule check-ups. Even if you have been relatively stable, it is a good idea to see your doctor at least every 6-12 months. This helps demonstrate to the insurance company that you are under the regular care of an attending physician. Insurance companies typically request medical records every 6-12 months.

Tip # 5:

If you don’t already have an ERISA lawyer, you might want to check in with one now. Your lawyer can work with your doctor to get the forms filled out the right way the first time.SUBMITTING THE APPLICATION Finally, your doctor has told you that resting without working is in the best interest of your health. You have agreed and have decided to apply for benefits.

Here is a checklist:

1.Request the short – and long-term disability application forms from your Human Resources (HR) department.

2.Request a copy of the short- and long-term disability policies from HR.

3.Take a stab at filling out the application forms, but do not feel limited to the boxes on the forms. If you need extra space, include an addendum. If the question on the form doesn’t really apply to you, modify the question and answer tostate what needs to be said about why you are disabled.

4.Make sure that your employer knows they will have to fill out a form verifying your income and job duties.

5.If it’s too overwhelming, ask an ERISA attorney to check your work to make sure that your application gives you the best shot at success.

6.If your application is denied, you should never attempt to appel on your own without the benefit of some legal advice.

Know Disability Benefits Before Accepting A Job Offer

You found it: the perfect job for your next career move with a great salary. You are ready to give your acceptance! But before you do, understand what’s really included in the “benefits package” that your future employer described to you in broad strokes. Yes, there is health insurance and 401(k) matching, but an often-overlooked benefit that becomes crucial in a time of need is your employer’s long-term disability insurance benefit.

Many employers provide a long-term disability insurance policy to employees, which most employees could care less about because no one intends to be taken out of their profession by a disability. Yet a disability can come in many forms, and there are visible and invisible disabilities. You may be entitled to a disability benefit because you are recovering from a surgery, because you experience pain, because you have a degenerative condition, because you suffer from a brain injury, because you have a life-threatening condition, or due to mental health issues. Although you hope to never need to make a disability claim, it’s smart to be aware of what the plans provide should you need to make a short- or long-term disability claim.

The finances:

Disability insurance plans typically cover 60-66.67% of your base income. In general, if you pay the premiums with after-tax dollars as a payroll deduction, then the benefit is non-taxable. If your employer pays the premiums, then the benefit is taxable. Therefore, if you have the option, CHOOSE TO PAY THE PREMIUMS YOURSELF! The tax savings should you become disabled will be well-worth the monthly premium cost.

Disability insurance benefits typically pay through Social Security Normal Retirement Age, which is age 67 for those born in 1960 and later. A monthly income for the years when you are unexpectedly taken out of the workforce, particularly if your disability is expected to last for the rest of your life, is wonderful peace of mind.

Most disability insurance policies, however, cap the “maximum benefit” payable to a certain dollar amount per month. The lowest cap I’ve seen is $6,000 per month. The highest cap I’ve seen is $30,000 per month. If your plan has a low cap that would not be enough to sustain your quality of life if you become disabled, either reconsider the job offer or take our private disability insurance. You may even use this need for private insurance as a bargaining chip to negotiate for a higher salary, as such insurance is typically quite expensive.

The logistics:

Just because a disability benefit plan is offered, does not mean that approval for benefits under that insurance plan will be a piece of cake. If you have a disability that is degenerative in nature, take some time to plan your exit strategy over several months with your doctor’s advice. Work until your physician advises that you no longer should, and then seek the advice of an experienced ERISA attorney to guide you through the application process to ensure the best chance of success at the outset.

With some basic knowledge and the right planning, ERISA disability insurance benefits can be a valuable addition to your compensation package.

Cassie Springer Ayeni is the President of Springer Ayeni, A Professional Law Corporation, where she represents individuals in disability benefit applications, appeals, and lawsuits. She can be reached at www.benefitslaw.com

For more contact: Cassie Springer Ayeni

Read More

In the Kingdom of the Sick: An ERISA Disability Lawyer’s Perspective

In the Kingdom of the Sick: An ERISA Disability Lawyer’s Perspective

By Cassie Springer Ayeni

Springer Ayeni, A Professional Law Corporation

“‘Illness is the night-side of life, a more onerous citizenship. Everyone who is born holds dual citizenship, in the kingdom of the well and the kingdom of the sick . . . sooner or later each of us is obliged, at least for a spell, to identify ourselves as citizens of that other place.’” – In the Kingdom of the Sick at p. 4 (quoting Susan Sontag).

In Laurie Edwards’s book on chronic illness, In the Kingdom of the Sick: A Social History of Chronic Illness in America, she takes a broad approach to explain obstacles that people suffering from chronic illness currently encounter.

Chronic Illness Defined

Edwards identifies three primary traits in chronic illness: “the symptoms are invisible, symptoms and disease progression vary from person to person, and the disease progression and worsening or improvement of symptoms are impossible to predict.” (pp. 32-33.) She also notes that chronic illness is “treatable, not curable.” (p. 33.) Moreover, chronic illness is often accompanied by its life-altering companion, chronic pain, which can make it “excruciating to engage in physical activities, keep up with a regular work schedule, or even leave the house.” (p. 111.) And it is pervasive. According to Edwards, chronic illness, which includes heart disease, diabetes, cancer, and asthma, affects nearly 50% of the population. (p. 11.) An astounding 81% of hospital admissions are a result of chronic illness, as are 76% of all physician visits. (p. 11.)

Biases Against People with Chronic Illnesses

Edwards devotes much of In the Kingdom of the Sick to explaining the biases that those living with chronic illness encounter, both from an historical perspective and in the modern medical era. For example, Edwards notes that where conditions lack a cure, which is one of the inherent traits of chronic illness, “blaming the patient often follows suit.” (p. 6.) This bias of skepticism leads to potentially devastating consequences: “45 percent of patients with autoimmune disease were labeled as chronic complainers early in their diagnostic journeys, with the resulting delay in diagnosis often leading to organ damage from lack of appropriate treatment.” (p. 78.) In my experience representing ERISA disability claimants for the past 15 years, this inclination towards disbelief extends to the disability insurance context as well, where before a concrete diagnosis is reached insurers are inclined to deny a claim for disability benefits that are based on “self-reported symptoms,” and claimants who cannot seem to overcome their undiagnosed or misunderstood conditions are labeled as “malingerers.” Indeed, these biases have become so pervasive that the trend in long-term disability plans is to limit the duration of benefits payable for “self-reported conditions,” which is an ever-expanding group of non-fatal, but totally disabling conditions. Claimants are often left high and dry after receiving the maximum duration of benefits, but still prevented by their lifelong illnesses from returning to gainful employment.

Additionally, most ERISA disability plans are written with a 24-month or shorter maximum duration for “mental illness” conditions. However, as Edwards points out, people with chronic illness often have secondary depression and anxiety: “what if the person is anxious because he or she has been sick for weeks or months and physicians can’t seem to help? What if the person is depressed because he or she is at home sick, isolated from social events and falling behind in work?” (p. 107.) In my experience, many disability claims adjusters try to label the mental component as primary in order to justify limited payment duration, often ignoring the severity of the underlying physical condition.

Edwards also does an excellent job examining the historical and pervasive bias against illnesses that primarily strike women. She states: “throughout history, deeply ingrained ideas about women as unreliable narrators of their pain and symptoms, as weaker than men, and as histrionic or otherwise ‘emotional’ have had a profound impact on their ability to receive accurate diagnoses and appropriate care.” (p. 20.) Added to this inherent bias is the fact that until very recently, “[w]omen were navigating a hierarchical medical system dominated by males; women lacked knowledge and resources to advocate for their health.” (pp. 76-77.) Although times are changing as there are more women doctors and as studies are increasingly inclusive of women patients, women with chronic illnesses still encounter shades of these gender biases when diagnosed with conditions like chronic fatigue syndrome, where people “roll their eyes at [these patients] or come right out and tell [them] that CFS is a made up disease, a present-day hysteria, or that ‘everybody gets tired.’” (p. 103.)

Chronic Illness and ERISA Claimants

Edwards aptly notes that people with chronic illnesses are often not able to be accommodated by their employers, since the ability to maintain a regular work schedule is a job necessity. (p. 66.) A disability claim is the inevitable conclusion, where the claimants must then “prove” their disability to the insurer. However, the insurer may be skeptical because of the nature of chronic illness, where sufferers experience some days that are better than others. Edwards notes that such fluctuation is a hallmark of chronic illness: “The unpredictability of symptoms and their severity that sets chronic illness apart from certain physical disabilities can also make for ‘unreliable activists,’ individuals who might be able to run workshops or attend policy meetings one day and be bedridden the very next.” (p. 53.) The chronically ill ERISA claimant may encounter the same culture of skepticism in the insurance context that she likely already experienced when seeking treatment for what ultimately became a disabling condition. And this culture of disbelief extends to the health benefit context as well. Edwards poignantly recounts her own experience with chronic illness, stating “I am grateful for the excellent health insurance that I work incredibly hard to provide for my family, and even with that, there are always letters to write, explanations to offer, and battles to wage to convince the people in charge of approving claims that preventative care is truly medically necessary.” (p. 193.)

Skepticism in LTD benefit applications couples with the shame that many chronically ill patients experience in admitting disability to begin with. Edward quotes the experience of one woman who had to apply for Social Security Disability Insurance, which is often a requirement of ERISA LTD applicants: “‘I’m depressed about it because I prefer to live in denial that this is going to be a long-lasting or permanent condition. And I’m embarrassed because even though rationally I know SSDI is an insurance policy that I paid into since I got my first job at age fourteen, it feels like asking for a handout. Like it’s trying to go on welfare.’” (p. 55.)

And still another obstacle faced by many ERISA LTD applicants who are chronically ill is the shock of surveillance that captures “clustering” activities to periods of increased energy, which often then results of days of bed rest to make up for the exertion. Edwards notes that such behavior is a pain management technique rather than an indication of sustained energy, and details that chronically ill patients must engage in extensive planning ahead of time before engaging in everyday routines. (p. 103.)

A Validating Resource for Patients

Overall, In the Kingdom of the Sick is an excellent resource for people suffering from chronic illnesses to obtain comfort that their experiences of disbelief, bias, and isolation are not unique. However, because chronic illness is such an extensive topic, at times the book is painted in too-broad strokes. Edwards tries too hard to lump all chronic illnesses together, such as AIDS, CFIDS, and cancer, to draw the tenuous analogy that people are biased universally against those with chronic illness. The diseases and the movements behind the diseases may have some links, but are also very distinct, and each disease has its own social bias to overcome to generate more attention and funding.

In this lumping together, Edwards also misses the distinguishing factor in chronic pain conditions – most are not inherently fatal. She criticizes that the NIH spends 96% less money on chronic pain research than on cancer, cardiovascular disease, and diabetes combined, but these are all potentially life-threatening whereas chronic pain is perceived as more manageable.

Nevertheless, I would certainly recommend that my clients who are suffering from debilitating chronic illnesses read In the Kingdom of the Sick to understand the historical context of chronic illness and to understand the legitimacy of their own experiences and feelings surrounding their illnesses. I would also recommend that attorneys and doctors alike who are interested in being more compassionate caretakers of their clients and patients read this book. And, in a dream world, every insurance claims adjuster would read it too before making assumptions tinged with societal bias.

Cassie Springer Ayeni is the President and Founder of Springer Ayeni, A Professional Law Corporation, in Oakland, CA, where she focuses on ERISA disability and life insurance cases. She can be reached atcassie@benefitslaw.com or www.benefitslaw.com

Read More

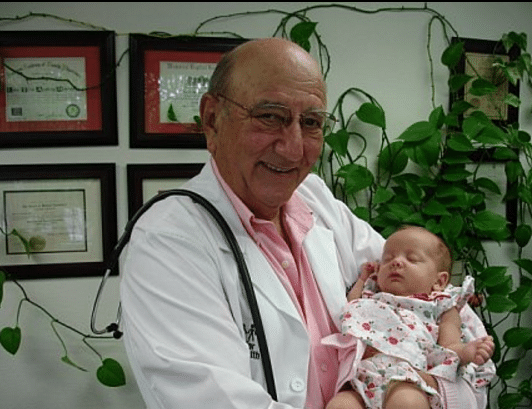

Medical Professionals Who Have Disabilities: Why I Like to Help

By Cassie Springer Ayeni

I’ve developed a bit of a niche within my specialization of employee benefits (ERISA) law: I have helped numerous medical professionals secure their partial or complete disability benefits. My clients have been OBGYNs, family medicine practitioners, physical therapists, PICU M.D.s, gastroenterologists, specialized nurses, and more. I wonder: do I gravitate to them or do they gravitate to me?

I’ve always been a money saver, and to further that goal I started working during summers and after school when I was 13 years old. One of my favorite teen jobs was in the file room of my father’s medical office. I would take slips of dictation and put them into the right patient’s file, skimming the details and, without knowing it, becoming familiar with medical terminology and the fascinating process of diagnosis. I loved reading the symptoms, findings, and conclusion that came from every interaction and examination. I got a lot of paper cuts, but I also learned early lessons in medical analysis and interpretation.

My father is one of a dying breed in the world of medicine: a jack of all trades. He’s a family practitioner, and in the 1970s he even used to deliver babies. He performs and assists on surgeries, sees people of all ages, and is loved by his patients. I am the middle child of the 6 he fathered, and he once told me he thought I would take over his practice someday. But I excelled in writing, not chemistry, and my passion for analysis fell to the pages of Jane Austen and later Supreme Court cases, not to Gray’s Anatomy.

Yet here I am, 15 years into a career that involves reading and interpreting medical records every day, just as I did in my father’s office so many years ago. This time, though, I am reading these records for evidence in support of my client’s employee benefits disability claim against an insurer. I have read through hundreds of thousands of pages of medical records in my career, MRIs, CT Scans, labs and more, figuring out medical shorthand along the way, to make arguments to insurance companies and courts about why the medical evidence demonstrates a lack of work capacity.

Maybe it’s this familiarity with the tools of the trade that has resulted in a plethora of medical professionals as clients: I respect their craft and understand the tip of the iceberg, so I am particularly eager to help these clients out when a disability causes them to cut back their duties or stop working altogether. Whatever the reason, I certainly enjoy representing doctors and nurses, and I feel so fulfilled when one of my medical professional clients recommends a colleague connected to her/him. And by the way, my father is 75 years old and still working nearly full-time as a physician. Life Goals.

Cassie Springer Ayeni is the President of Springer Ayeni, A Professional Law Corporation, in Oakland and San Jose, California. She focuses on representing people in ERISA disability and life insurance cases. She can be reached at cassie@benefitslaw.com or www.benefitslaw.com

Read More

Reforming Disability Claim Procedures Under ERISA

On Dec. 19, 2016, the U.S. Department of Labor published in the Federal Register sweeping reforms to the regulations it issues under Section 503 of the Employee Retirement Income Security Act, aimed at eliminating bias in the ERISA disability claims and review process.

Despite ERISA’s reputation as an erudite law affecting primarily pension plans, the DOL reports that, “An empirical study of ERISA employee benefits litigation from 2006 to 2010 concluded that cases involving long-term disability claims accounted for 64.5 percent of benefits litigation whereas lawsuits involving health care plans and pension plans accounted for only 14.4 percent and 9.3 percent, respectively.” (p. 3.) Hence the DOL’s decision to take aim at the regulations affecting disability plan administration, which is typically handled by insurance carriers.

The DOL noted “the economic incentive for insurance companies to deny otherwise valid claims and because plans are often able to secure a deferential standard of review in court.” (p. 8.) Although the DOL received commentary that disability claims administrators should not be subject to the same rigorous regulations issued under the Affordable Care Act to health plan administrators, “the department views enhancements in procedural safeguards and protections similar to those required for group health plans under the Affordable Care Act as being just as important, if not more important, in the case of claims for disability benefits.” (p. 10.) It noted the need for transparency and accountability in all claims handling. (p. 11.)

The department enhanced protections for disability plan participants in eight ways (pp. 11-12):

Increased independence and impartiality of the decision makers

Adverse decisions must fully explain the reasons for the denials and why evidence of the claimant was disagreed with

Notification to claimants of the right to obtain their claim file and other documents before a final decision is made and to present testimony and other evidence in support of their claim

Provision of an opportunity for claimants to respond to adverse medical opinions before a final decision is made

A guarantee that a claimant can proceed to litigation if the administrator fails to comply with the DOL regulations (stricter than “substantial compliance”)

A guarantee that a rescission of coverage triggers appeal rights under the regulations

Cultural and linguistically appropriate requirements for communications

A requirement that the notice of an adverse benefit determination on review must include a description of any applicable contractual limitations period and its expiration date (p. 54)

But perhaps the biggest protection is the first, requiring impartiality not just in claims decision makers, but also in vocational experts, medical consultants and in-house medical reviewers. (pp. 13-15.) And the DOL understood and took issue with the notion that impartiality could be achieved if the administrator, for example, hires a company who then hires the medical expert for review. It stated: “The text of the rule does not limit its scope to individuals that the plan directly hires. Rather, the rule’s coverage extends to individuals hired or compensated by third parties engaged by the plan with respect to claims.” (p. 15.) It cautioned that such a prohibition should not temper a court’s inquiry into the neutrality of the expert, noting the availability of discovery to probe such matters. (p. 16.)

The DOL further disabused the insurance practice of rejecting experts that would support an approval of benefits in favor or experts that would support denial as inappropriate “expert shopping.” (p. 20.) It found that “[r]equiring plans to explain the basis for disagreeing with experts whose advice the plan sought” should help that problem. (p. 20.) The department couched the requirement to explain disagreement with medical and vocational professionals in denying a claim “as a matter of basic fiduciary accountability.” (p. 22.)

Regarding Social Security disability awards, the department was careful to specify that although it does not expect administrators to defer to a favorable Social Security disability determination, “a more detailed justification would be required in a case where the U.S. Social Security Administration definitions were functionally equivalent to those under the plan.” (p. 25.) It refused, however, to adopt the “treating physician rule” present in Social Security decisions, where the administrator must defer to the opinion of the treating physician. (p. 25.)

The department vigorously defended its decision to allow claimants to review and rebut evidence that would be used to deny a claim. Commenters argued that claimants could provide an endless loop of evidence supporting a claim that the administrator would have to rebut endlessly as well. The DOL dismissed that argument as contrary to fiduciary obligations: “The fiduciary obligation to pay benefits in accordance with the terms of the plan does not require a fiduciary to endlessly rebut credible evidence supplied by a claimant that, if accepted, would be sufficient to justify granting the claim. In fact, an aggressive claims-processing practice of routinely rejecting or seeking to undermine credible evidence supplied by a claimant raises questions about whether a fiduciary, especially one operating under a conflict of interest, is violating the fiduciary’s loyalty obligation under ERISA to act solely in the interest of the plan’s participants and beneficiaries.” (p. 37.)

Controversially, the department approved a “tolling” of timelines for responding to claims and appeals where the claimant submits additional evidence for the administrator to consider. “In the department’s view, the current disability claims regulation ‘special circumstances’ provision permits the extension and tolling expressly added to the group health plan rule under the ACA claims and appeals final rule.” (p. 40.) It remains to be seen if this will deny claimants swift access to the courts or even allow a statute of limitations to expire while tolling is in place. See Heimeshoff v. Hartford Life & Accident Insurance Co., 134 S.Ct. 604, 611 (2013). Perhaps in anticipation of this conundrum, the department addressed the potential problem raised by the Heimeshoff decision where a statute of limitations could expire while a participant was engaging in the mandatory review process prescribed under ERISA Section 503. It stated:

First, Section 503 of ERISA requires that a plan afford a reasonable opportunity to any participant whose claim for benefits has been denied for a full and fair review of that decision by 53 an appropriate named fiduciary. The department does not believe that a claims procedure would satisfy the statutory requirement if the plan included a contractual limitations period that expired before the review was concluded …

A limitations period that expires before the conclusion of the plan’s internal appeals process on its face violates ERISA Section 503’s requirement of a full and fair review process. A process that effectively requires the claimant to forego the right to judicial review and thereby insulates the administrator from impartial judicial review falls far short of the statutory fairness standard and undermines the claims administrator’s incentives to decide claims correctly. (pp. 52-53.)

It further stated that a contractual limitations period that does not permit a lawsuit after the conclusion of an administrative appeal “is unenforceable.” (pp. 53-54.) In an effort to provide transparency, the department will now require administrators to state any contractual limitations period “including the date by which the claimant must bring a lawsuit” in a final adverse decision. (p. 53.)

However, the department did not provide much leeway for plan administrators to avoid litigation for failing to comply with the regulations. In fact, for the administrator to argue failure to exhaust administrative remedies despite noncompliance, the administrator’s failure to comply must be all of the following: “(1) de minimis; (2) nonprejudicial; (3) attributable to good cause or matters beyond the plan’s control; (4) in the context of an ongoing good-faith exchange of information; and (5) not reflective of a pattern or practice of noncompliance.” (p. 42.)

The department refused to provide a general rule on the level of deference an administrator would receive from a reviewing court, but did indicate that where the administrator’s noncompliance has resulted in a claim’s deemed exhaustion, the “legal effect of the definition may be that a court would conclude that de novo review is appropriate because of the regulation that determines as a matter of law that no fiduciary discretion was exercised in denying the claim.” (pp. 43-44.)

Read More

PRACTICE GUIDE: ERISA ISSUE SPOTTING – HOW TO AVOID MALPRACTICE

ERISA. The acronym strikes terror in the heart of many a lawyer. Fuzzy notions of fiduciary duties, equitable remedies in the days of a divided bench, and preemption can cause even the most erudite of attorneys to break into a cold sweat. My friends: speaking as someone who has handled ERISA claims, litigation, and appeals for 15 years, I’m here to tell you that it is really not that bad! Allow me to walk you through some ERISA basics so that you can issue spot and avoid malpractice.

ERISA Fundamentals

The Employee Retirement Income Security Act of 1974 (ERISA) provides minimum standards for voluntarily established benefit plans in the private industry. In addition to pension plans, ERISA governs health and welfare benefit plans, including employer-sponsored disability and life insurance plans. ERISA does not cover benefit plans established or maintained by governmental entities, churches for their employees, or plans which are maintained solely to comply with applicable workers compensation, unemployment, or disability laws. This means that UC plans are non-ERISA (government) plans, but an employer’s benefit plans are governed by ERISA.

ERISA requires plans to provide participants with plan information. ERISA § 104(b)(4). Those who manage and control plan assets must act as fiduciaries. ERISA § 404. ERISA plans must have a grievance and appeals process for benefit claims. ERISA § 503. The process of appealing a denied benefit claim is also called a “request for review,” and is crucial to achieving success on a denied benefit claim, either with the administrator or before a federal court. TIP: There is a 180-day deadline for submitting ERISA appeals that CANNOT be missed. Finally, ERISA gives participants and beneficiaries the right to sue for benefits and breaches of fiduciary duty. ERISA § 502(a). Lawsuits related to or remedied by ERISA are brought in federal district court. Statutes of limitations are often identified in the ERISA plans themselves and must be adhered to.

ERISA Preemption

ERISA has broad preemption provisions. ERISA § 514. If a remedy is available under ERISA, the claim will be preempted. If a case “relates to” an ERISA plan because there is a “connection with or reference to” a plan, the case will be preempted. Metro. Life Ins. Co. v. Massachusetts, 471 U.S. 724, 739. For example, in Ingersoll-Rand Co. v McClendon, the Supreme Court held that a wrongful discharge action was preempted by ERISA because the plaintiff alleged that the wrongful termination was primarily because of the employer’s desire “to avoid contributing to, or paying benefits under, the employee’s pension fund.” 498 U.S. 478, 483 (1990). However, in another case, the Supreme Court determined that California’s prevailing wage law is not preempted by ERISA because the law does not “make reference to” ERISA plans, nor does it have a connection to an ERISA plan because “[t]he prevailing wage statute alters the incentives, but does not dictate the choices, facing ERISA plans.” California Div. of Labor Standards Enf’t v. Dillingham Const., N.A., Inc., 519 U.S. 316, 328, 334 (1997).

As a general rule, if the alleged harm is that the unlawful conduct interfered with a right to receive, vest in, or accrue an employee benefit, then the claim will be preempted. Ingersoll-Rand Co. v. McClendon, 498 U.S. 133 (1990) (preempting a common law wrongful discharge claim where the claim was that the employer retaliated to prevent vesting in an ERISA plan). TIP: If you are concerned that your case will be pre-empted by ERISA, avoid alleging that any remedies are available under any kind of employee benefit plan or that any claims bear a connection to an employee benefit plan. Do NOT allege that the bad behavior caused a loss of employee benefits. Do NOT allege that the bad behavior should result in payment of disability or other ERISA benefits. These allegations will cause you to be removed to the federal courts that have exclusive jurisdiction over ERISA claims. And, if the claim is properly an ERISA claim for benefits, then there will be no consequential or punitive damages available, nor will there be a jury trial.

However, ERISA’s “savings clause” provision saves from preemption any law that regulates insurance, banking, or securities. ERISA § 514(b)(2)(A). An example of the application of the savings clause is in California’s “notice prejudice” rule, which provides that claims can proceed even where there is late notice unless the insurer is prejudiced by the late notice. Because this is a law that regulates insurance and does not provide a remedy that conflicts with ERISA, the law is not preempted. UNUM Life Ins. Co. of Am. v. Ward, 526 U.S. 358, 373, 119 S. Ct. 1380, 1389, 143 L. Ed. 2d 462 (1999).

ERISA Long-Term Disability Cases

While most people are familiar with ERISA governing pension plans, 80% of all ERISA litigation is actually over denied long-term disability (LTD) benefits.

- What is the LTD benefit?

Employer-sponsored LTD plans, also known as “group” disability insurance plans, generally provide benefits after 6 months of disability until retirement age. The benefit is typically 2/3 of pre-disability earnings. Unlike private disability plans, almost all ERISA LTD plans will offset other income or benefits including severance, workers’ compensation, Social Security Disability, state disability, and even retirement benefits received. TIP: if you are negotiating a settlement for your client, be sure that it cannot be characterized as an off-settable source of income to the ERISA LTD benefits, or the client will essentially have to hand over the settlement funds to the ERISA LTD insurer.

Example of a severance that will likely be offset 100%: “After the Separation Date, EMPLOYEE will receive payments from EMPLOYER totaling $65,000, constituting salary continuation, accumulated sick leave, lost wages, and severance pay.”

Example of a severance that will not likely be offset: “After the Separation Date, EMPLOYEE will receive payments from EMPLOYER totaling $65,000 as consideration for waiving the claims specified herein. This amount does not constitute salary continuation, accumulated sick leave, lost wages, or severance pay.”

If it is impossible to avoid the triggering language, just leave out the description as a last resort.

- When Is Someone Disabled?

Many ERISA LTD plans have an “own occupation” standard of disability that shifts to an “any occupation” standard of disability after 24 months. In other words, after 24 months, the claimant has to be disabled from any occupation given her education, training, experience, and station in life, to continue to receive LTD benefits.

Many ERISA LTD plans also have a 2-year limitation for certain conditions. Common limitations include mental illnesses, “self-reported” conditions, neuro-musculoskeletal disorders, chronic fatigue conditions, chronic pain conditions, allergies, and chemical sensitivities. TIP: if you are working with a disabled client’s physicians and there are also emotional distress issues, be aware that the mental health component should be listed as secondary to the physical component of the disability to avoid the 24-month mental health limitation in the ERISA LTD plan.

Types of Plans

There are two types of ERISA LTD Plans: insured and self-funded. With self-funded plans, the employer sets aside funds for qualified participants. Because the risk of payment lies with the employer, usually big employers like AT&T or Johnson & Johnson are the only employers providing self-funded plans. With these plans, non-preempted state law insurance protections do not apply. With insured plans, the employer purchases an insurance policy to provide disability benefits to its. Often, the insurer both decides liability and pays the benefits. The Supreme Court recognizes this as a structural conflict of interest. Metropolitan Life Ins. Co. v. Glenn, 128 S. Ct. 2343 (2008). In my experience, some insurers are better than others. Standard Insurance currently has the worst definition of disability, limiting so many conditions to 24 months that it shocks me when someone is eligible for benefits beyond two years; Liberty Mutual is particularly cantankerous in litigation.

POP QUIZ!

Time for some ERISA issue spotting!

1. If someone has a disability or other employee benefit claim, does ERISA govern if the employer is:

A: A private company?

B: Government (U.C., federal employee, state employee, public school teacher)?

C: A partnership that covers both partners and employees?

D: A private company where there are only owners but no employees?

Answers: A: Yes; B: No; C: Yes; D: No (there must be an employee covered as well for ERISA to govern)

2. If someone has been disabled from her “own occupation” for 24 months, then the plan switches to an “any occupation” standard of disability, is she still entitled to benefits where she is:

A: a lawyer with bipolar disorder who is told by the insurer to go get a job as a manual laborer?

B: a construction worker who has a high school education but who also has lifting restrictions, where the insurer tells her to go get a job as a receptionist for a construction company?

Answers: A: No (not appropriate given education, training, experience, and station in life); B: Yes (as long as the salary matches her station in life)

3. What allegations will be preempted by ERISA?

A. Discrimination caused the employee to lose accrual of retirement benefits.

B. Emotional distress resulted from denied disability claim.

C. Employee was not paid fair wages.

D. California’s “notice prejudice” rule trumps an ERISA Plan’s claim filing deadline.

Answers:

A: Preempted – remedy of restored retirement conflicts with ERISA’s remedy for a breach of fiduciary duty claim. Ingersoll-Rand Co. v McClendon, 498 U.S. 478, 483 (1990);

B: Probably preempted: one court has recently held that emotional distress claims, if they are independent from the lost benefit claims, can proceed in state court. Daie v. The Reed Grp., Ltd., No. C 15-03813 WHA, 2015 WL 6954915, at *3 (N.D. Cal. Nov. 10, 2015) (“Our defendants’ duty not to engage in the alleged tortious conduct existed independent of defendants’ duties under the ERISA plan.”);

C: Not preempted: California Div. of Labor Standards Enf’t v. Dillingham Const., N.A., Inc., 519 U.S. 316, 328, 334 (1997);

D: UNUM Life Ins. Co. of Am. v. Ward, 526 U.S. 358, 373, 119 S. Ct. 1380, 1389, 143 L. Ed. 2d 462 (1999).

A Final Tip: Don’t Waive Your Client’s ERISA Claims in a Severance Agreement

Finally, many clients call me after having accepted a “standard” severance agreement from their employer, where they unknowingly waived their ERISA disability claim rights. Oops! While ERISA pension claims vest and cannot be waived, the same is not true for ERISA health and welfare claims, including disability claims. Please be sure that your clients do not waive their ERISA rights, as their disability and life insurance plans in particular may be far more valuable to them than the severance itself. Employers are generally willing to agree to carve out ERISA disability and life insurance claims once they understand the ramifications.

Example of a good ERISA carve-out: … However, the following claims are specifically and expressly excluded from the foregoing Release: (i) health insurance benefits under the Consolidated Omnibus Budget Reconciliation Act (COBRA); (ii) claims with respect to benefits, including short- and long-term disability benefit benefits, under a welfare benefit plan governed by the Employee Retirement Income Security Act (ERISA); or (iii) claims with respect to vested benefits under a retirement plan governed by ERISA.

If you ever have a question about how to navigate ERISA’s tricky waters, call an experienced ERISA attorney. Us ERISA nerds are typically happy to field questions and co-counsel if you find yourself in over your head. I can be reached at cassie@benefitslaw.com if you have any questions. You can also find more information about ERISA on the Department of Labor’s Employee Benefits Security Administration (EBSA) website, at https://www.dol.gov/ebsa/.

Cassie Springer Ayeni is the President and Founder of Springer Ayeni, A Professional Law Corporation, in Oakland, CA, where she focuses on ERISA disability and life insurance cases. She can be reached at cassie@benefitslaw.com or www.benefitslaw.com

Read More