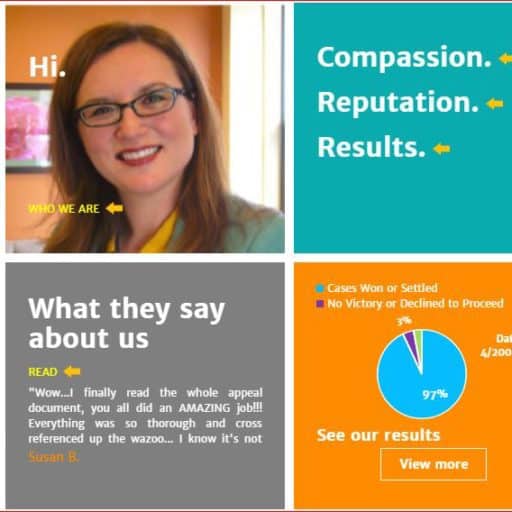

Her Firm’s Achievements & Results are Measured by the Satisfaction of Her Clients: A Conversation with Attorney Cassie Springer Ayeni

Q: When did you know you would pursue a career in the legal field?

CSA: As early as junior high or high school, I felt the need to advocate for others, to make a point to stand up for the kids who were being bullied or ostracized. I also realized around the same time that I truly enjoyed writing, reasoning, and debating. The law seemed a natural fit: I could use my skills to make a palpable difference in people’s lives. I had settled on a career in law by the time I was 16 and never looked back.

Q: Can you explain what types of cases an ERISA Attorney handles and why you chose this area of law?

CSA: I primarily help people with their employer-sponsored disability benefit claims. ERISA governs all private employer benefit plans, not just pension plans. Many employers provide disability benefit plans in addition to health and pension benefits. In fact, 65% of ERISA litigation is over denied disability benefit claims. The plans are often insured, and clients typically come to me after they stop working, apply for disability benefits to the insurance company, and are denied. I then step in to try to get their disability benefit income restored while they focus on their health.

Q: What is your approach or philosophy to winning or representing a case?

CSA: I lead with kindness. I want to understand truly what my clients have gone through medically, economically, and emotionally to get to this point in their lives, and how I can help. In representing a client, I am there for that person: I am responsive and listen with an open heart. I believe this the secret to winning a case as well – if I am doing my job right, I am painting a picture of the person and the case to help the court appreciate why my client is deserving of their disability benefits. I have the paintbrush and paint ready because I have spent months getting to know my clients and researching the law. And I also aim to be the best-prepared lawyer in the room with the most compelling brief … that helps too.

Q: If we interviewed all your past clients … what is “one” common word that comes up when they describe working with your law firm?

CSA: Compassion

Q: What are some of the most popular topics you are asked to lecture on?

CSA: I speak frequently on ERISA topics, especially in my current role as the co-chair of the ABA’s Employee Benefits Committee. I love presenting to newer attorneys about the fundamentals of ERISA litigation, because I am eager to energize attorneys about how engaging ERISA work is. ERISA is fun! The law is always evolving, providing constant intellectual stimulation, and practicing ERISA law is also a great way to help people in need. I also enjoy speaking to women about re-defining what it means to be a successful litigator, and how to challenge traditional law firm standards to achieve a better work-life balance.

Q: What advice would you give to young women who want to pursue a career as an Attorney?

CSA: Any woman who wants to pursue a career as an attorney should make sure that her potential work environment values diversity and inclusion, fosters a sense of belonging, and creates opportunities for women at every turn. If she is unable to find that environment, she should open her own law firm and create those opportunities herself.

Q: How do you maintain a work/life balance?

CSA: Being the owner of my firm allows me to make up the rules: I look to the best practices of progressive companies and pick policies that I believe are imperative to work/life balance for everyone. I figure that everything I need to raise four children and work full-time as an attorney is what everyone at my firm needs too. I offer unlimited PTO, great benefits, four months of fully paid maternity leave, the ability to bring children in to work as needed (in fact I have brought each of my babies into work until they needed another environment), the ability to work from home, and a practical approach to parenting … like closing the office on Halloween and Valentine’s Day so that we can all attend class parties without rushing to or from work. I, of course, avail myself of each of these policies, which is why I created them in the first place. That’s not to say that I don’t wake up early to work for a bit so that I can focus fully on my kids to take them to school, or grab a few hours on the weekend to pound out a brief, but family always comes first, for me and for everyone who works at Springer Ayeni.

Q: What’s one lesson you’ve learned in your career that you can share with our audience?

CSA: I have always learned to be myself. If you are authentic, you are compelling as an advocate and a counselor: you listen and communicate better when you are not spending energy on worrying about how you should come across. I also believe in the power of preparation. If you are committed to doing your best and preparing your utmost, then even a negative outcome cannot be met with regret, but a positive outcome is much more likely. And if you’re nervous before a court appearance or speaking engagement, just take a breath and realize that even in a worst-case scenario, you will survive and move forward … we all do.

Q: What are some of the challenges you feel women face today?

CSA: Looking at women lawyers only, there is much progress to be made. As Joan Williams at the UC Hastings Center for WorkLife Law has analyzed convincingly, women lawyers (and women in other fields too) are asked to “prove it,” then “prove it again.” In other words, women need to do the job before getting the promotion, whereas men are promoted based on potential. This is a major obstacle to women’s promotion and needs to be addressed systematically.

Five Things About Cassie Springer Ayeni

1. If you could talk to one famous person past or present, who would it be and why?

There are so many! But if I had to pick one it would be Harriet Tubman – her courage and vision even in the face of medical problems were and are awe-inspiring.

2. What’s your favorite holiday? Why?

Valentine’s Day! I don’t view it as just a romantic holiday, but as a day to express to those around you how much you care.

3. If you were a superhero, what would your special powers be?

Time-traveling. That would be magical!

4. What app can’t you live without?

Facebook – it has allowed me to make great connections with other lawyer moms – lawmas!

5. Favorite food to eat?

Strawberries. Now, then, forever, and always.

See the interview at https://bayareawomenmag.com/news/view/11665/Her_Firms_Achievements_-_Results_are_Measured_by_the_Satisfaction_of_Her_Clients_A_Conversation_with_Attorney_Cassie_Springer_Ayeni

Read More

How To Apply For Long Term Disability Benefits When You Need to Stop Working

By Cassie Springer Ayeni

You never thought it would happen.

You thought you would work until retirement or beyond, but then along came your vestibular disorder. Now, focusing on a computer screen is a challenge; someone has to drive you to work; walking is a safety hazard; and your concentration is not what it used to be. All of these symptoms can interfere with your ability to do the material duties of your occupation, and can make an attempt to get through a workday exhausting and frustrating as you struggle to complete tasks that used to be easy for you. You

see your doctor and she tells you the time has come to stop working due to your disability. Now what? How will you live without your income? Here are some options and a plan:THERE ARE SEVERAL SOURCES FOR DISABILITY BENEFITS Besides savings (and it is almost unheard of for someone in the prime of her

working life to have sufficient savings to live decently for the rest of her days), income sources for people with disabilities include:

1.Short-term disability insurance benefits through your employer (these usually last for 6 months).

2.Long-term disability insurance benefits through your employer (these usually start after 6 months and can last until retirement age).

3.Private disability insurance plans (insurance you purchased for yourself that can last through retirement age or beyond).

4.State disability insurance (usually lasts for a year, such as through California’s Employee DevelopmentDepartment “EDD”).

5.Social Security Disability benefits (SSDI) (available after being disabled for 6 months and lasting through retirement age).

6.Workers’ Compensation benefits (if your disability is due to a work-related injury).

In this article we will focus on the first two of these income sources: short- and long-term disability benefit plans offered by your employer. (See VEDA’s other articles on how to apply for SSDI.)Many employers offer group disabilityplans to their employees because the premiums are low and they can be a huge benefit to employees struck with a disability, whether short- or long-term. These benefits are usually paid by insurance companies such as Unum MetLife, Hartford, Principal, Standard, Cigna/Lina, Guardian, Sun Life, and others.A complex area of law called ERISA (the Employee Retirement Income Security Act) governs these employee benefit plans, even though you apply to an insurance company for payment of the benefits. Under ERISA, there are technical rules governing timelines for the insurance company to decide whether to pay your claim. It is a good idea for you to get help with your disability application and, of course, with an appeal of any denials.

Important Tip: Even though you have a disability plan through your employer, you can still apply for all of the other disability benefits listed

above. However, the benefits are usually coordinated so that you only receive a fixed percentage of your salary altogether, usually 2/3 of yourprevious income up to a maximum benefit per month.

YOUR DOCTOR’S ROLE

Many people with vestibular disorders have a long-standing relationship with a supportive doctor. This relationship is instrumental to getting your disability benefit claims approved. Please make sure that your doctor knows how important it is that she fills out forms promptly so that your income stream can continue while you are not working. Here are some key tips for the “Attending Physician Statements” that you submit to the insurance company.

Tip #1:

Your doctor should answer the question “why is the patient disabled now?” especially if you have been struggling to work while symptomatic fora while. Did it worsen? Have your attempts to keep working caused a decrease in your performance? Is the fatigue from managing your symptoms getting the best of you, causing you to nap during the day? Are the symptoms interfering with your ability to perform the activities of daily living, such as preparing meals? Ask your doctor to be specific and make sure this is in your medical record.

Tip # 2:

One of the areas of misunderstanding with “invisible disabilities” like vestibular disorders is that a successful claim must depend on your report of “subjective” symptoms in addition to any objective tests. For the subjective symptoms to be deemed reliable by an insurance company, your

doctor should point out that you are credible in your symptom reporting. When your doctor notes this, it helps prevent the insurance company from doubting your credibility, an unfortunately common reality when insurance companies are looking for a way to cut costs. A good way to keep track of these symptoms is by keeping a log to share with your doctor: when you are nauseous or have a headache or a bout with vertigo, write it down in a log with a symbol for each symptom, then bring the log to every medical appointment.

Tip # 3:

If you have symptoms that can be objectively documented by testing, please get those tests done as soon as possible. For example, if you have concentration or other cognitive difficulties, ask for a referral for a neuropsychological examination, which provides objective evidence of those

symptoms.

Tip # 4:

Regularly schedule check-ups. Even if you have been relatively stable, it is a good idea to see your doctor at least every 6-12 months. This helps demonstrate to the insurance company that you are under the regular care of an attending physician. Insurance companies typically request medical records every 6-12 months.

Tip # 5:

If you don’t already have an ERISA lawyer, you might want to check in with one now. Your lawyer can work with your doctor to get the forms filled out the right way the first time.SUBMITTING THE APPLICATION Finally, your doctor has told you that resting without working is in the best interest of your health. You have agreed and have decided to apply for benefits.

Here is a checklist:

1.Request the short – and long-term disability application forms from your Human Resources (HR) department.

2.Request a copy of the short- and long-term disability policies from HR.

3.Take a stab at filling out the application forms, but do not feel limited to the boxes on the forms. If you need extra space, include an addendum. If the question on the form doesn’t really apply to you, modify the question and answer tostate what needs to be said about why you are disabled.

4.Make sure that your employer knows they will have to fill out a form verifying your income and job duties.

5.If it’s too overwhelming, ask an ERISA attorney to check your work to make sure that your application gives you the best shot at success.

6.If your application is denied, you should never attempt to appel on your own without the benefit of some legal advice.

Before Taking a Job Offer, Understand the Company’s Employee Disability Benefits By Cassie Springer Ayeni

You found it: the perfect job for your next career move with a great salary. You are ready to give your acceptance! But before you do, understand what’s really included in the “benefits package” that your future employer described to you in broad strokes. Yes, there is health insurance and 401(k) matching, but an often-overlooked benefit that becomes crucial in a time of need is your employer’s long-term disability insurance benefit.

Many employers provide a long-term disability insurance policy to employees, which most employees could care less about because no one intends to be taken out of their profession by a disability. Yet a disability can come in many forms, and there are visible and invisible disabilities. You may be entitled to a disability benefit because you are recovering from a surgery, because you experience pain, because you have a degenerative condition, because you suffer from a brain injury, because you have a life-threatening condition, or due to mental health issues. Although you hope to never need to make a disability claim, it’s smart to be aware of what the plans provide should you need to make a short- or long-term disability claim.

The finances:

Disability insurance plans typically cover 60-66.67% of your base income. In general, if you pay the premiums with after-tax dollars as a payroll deduction, then the benefit is non-taxable. If your employer pays the premiums, then the benefit is taxable. Therefore, if you have the option, CHOOSE TO PAY THE PREMIUMS YOURSELF! The tax savings should you become disabled will be well-worth the monthly premium cost.

Disability insurance benefits typically pay through Social Security Normal Retirement Age, which is age 67 for those born in 1960 and later. A monthly income for the years when you are unexpectedly taken out of the workforce, particularly if your disability is expected to last for the rest of your life, is wonderful peace of mind.

Most disability insurance policies, however, cap the “maximum benefit” payable to a certain dollar amount per month. The lowest cap I’ve seen is $6,000 per month. The highest cap I’ve seen is $30,000 per month. If your plan has a low cap that would not be enough to sustain your quality of life if you become disabled, either reconsider the job offer or take our private disability insurance. You may even use this need for private insurance as a bargaining chip to negotiate for a higher salary, as such insurance is typically quite expensive.

The logistics:

Just because a disability benefit plan is offered, does not mean that approval for benefits under that insurance plan will be a piece of cake. If you have a disability that is degenerative in nature, take some time to plan your exit strategy over several months with your doctor’s advice. Work until your physician advises that you no longer should, and then seek the advice of an experienced ERISA attorney to guide you through the application process to ensure the best chance of success at the outset.

With some basic knowledge and the right planning, ERISA disability insurance benefits can be a valuable addition to your compensation package.

Cassie Springer Ayeni is the President of Springer Ayeni, A Professional Law Corporation, where she represents individuals in disability benefit applications, appeals, and lawsuits. She can be reached at www.benefitslaw.com

For more contact: Cassie Springer Ayeni

Read More